Online entrepreneurs do not always decide to continue their business. Therefore, they often try to make a profit from the sale afterwards. They know that there is one thing that matters most when it comes to selling: the price for a web project. But how do you best determine this? Is there a way to calculate it? And if so, what is the formula for this?

Sure, as a seller you want to set a sales amount that does justice to the effort invested and the value of the web project. At the same time, interested parties often want to pay as little as possible and try to lower the price for a web project or do not even show interest when the price is set too high. One way to avoid this problem is to use the multiple method.

What is the multiple procedure?

In the multiple procedure, important key figures are set in relation to the company value. The advantage is that you get a quick estimate of a possible selling price. Of course, this only happens if the correct values are used.

Basically, the multiplier method works in such a way that the company value of the web project is based on the market price of comparable companies (peer group). The peer groups represent different industries with their own multiples. In principle, the company valuation is always based on supply and demand. You take the profit from one year and multiply it by the multiple. There can be considerable differences in the individual industries. For example, IT companies are currently very popular and can therefore charge eight times the price compared to other industries.

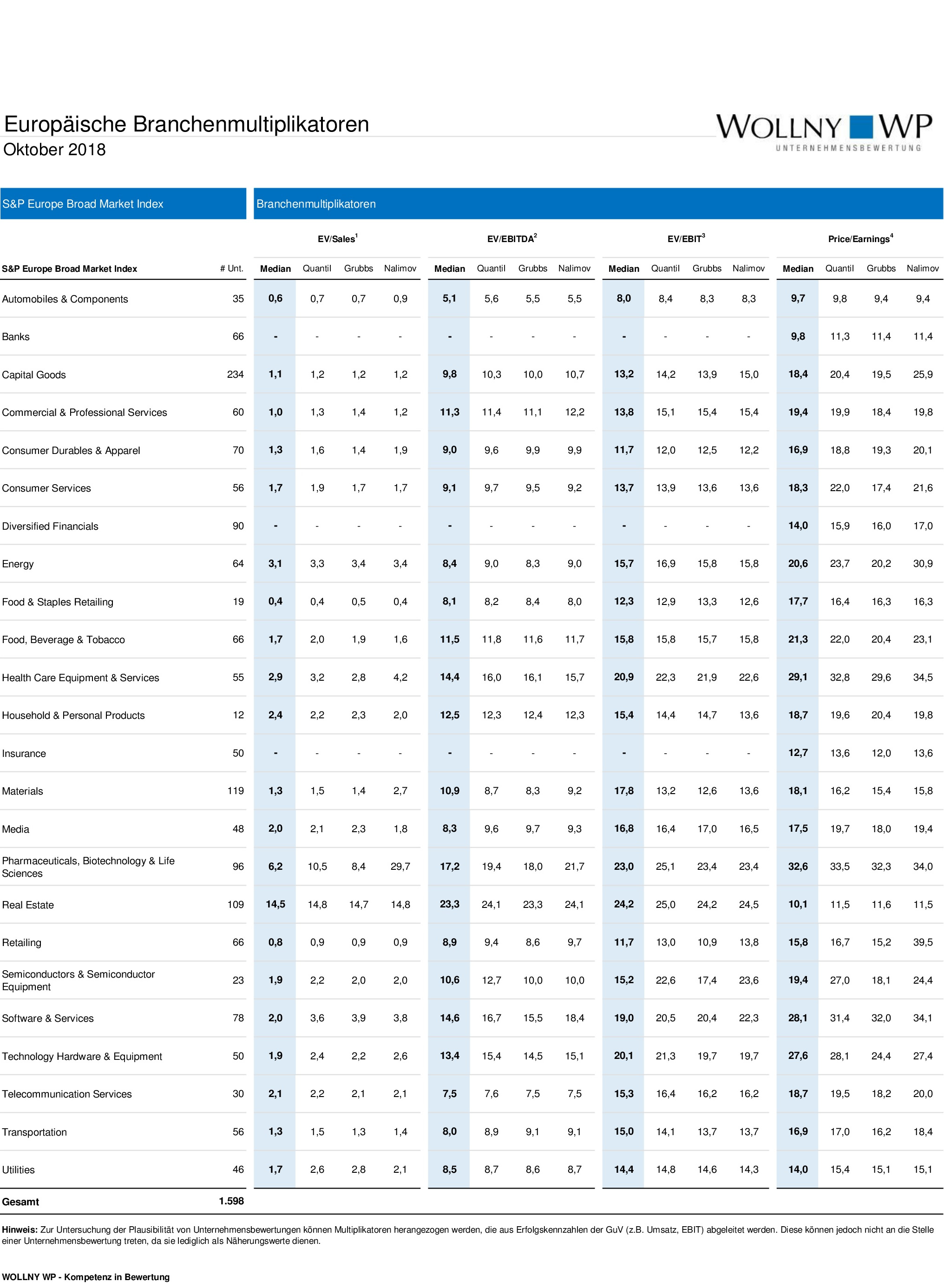

Current industry multiples can be seen in the following figure:

Source: https://www.wollnywp-unternehmensverarbeitung.de/unternehmensbeispiel-branchenmultiples/

To summarize again:

A result for a company valuation can be derived as the product of a multiplier (peer group) and the key figure of the web project.

The price for a web project, i.e. its determination using the multiplier method, should ideally be based on several multiples. However, multipliers do not always have to be based on financial figures. The following figure contains examples of other possibilities:

|

Branch |

multiplier |

|

Cellular |

number of customers |

|

hotel |

Number of beds or rent per room |

|

Breweries |

Number of liters |

|

Asset management |

Assets under management |

|

Internet companies |

Number of users |

As a rule, regardless of whether financial or non-financial multiples, the most recent values possible are used, since the financial ones in particular generally represent future values.

The following values are usually considered as reference values for financial multiples:

- P / E (“Price / Earnings”) or P / E ratio (“price / earnings ratio”)

- Price / cash flow

- EBIT

- EBITDA

- EV / Sales

Often the EBIT multiples preferred, as the profitability of the company is also taken into account here. Here on Projektify, too, in connection with our specially developed multiple, we use the EBIT method.

Real price vs market price

As beautiful as such a system with a formula is and as promising as the calculated price for a web project may be, the real price is not always the same as the market price. Let’s take the example of the IT company again, which can ask eight times as much: 800 percent can by no means be seen as a fixed value here. Perhaps that is exactly what the estimate using the multiplier method resulted in, but often you end up getting a whole lot less for the project on the market. It is therefore important to distinguish between the real price (calculation using multiples) and the market price (offers from buyers).

Multiple procedures for web projects

But even with the right method at the price of a web project, it can sometimes be difficult to find buyers. This is particularly due to the fact that buying web projects is still a niche business and people are currently not ready to pay large sums of money, as is the case in the USA, for example. However, we believe that the multiple will become significantly more important in the next few years.

For this reason, as already mentioned, we have developed our own way of determining the price for a web project. The calculation of this is based on the price analysis of 90 web projects that have already been sold on the Projektify platform. The formula is as follows:

12 months profit * 0.98 = web project price

At the same time, we at Projektify have an automatic algorithm that checks all web projects and evaluates them using the multiple method. Accordingly, all of our users receive an email with a notification as soon as we find the rating too high.

You have no profit? Then use our Projektify price calculator.

You also have the option of using our other services, such as the Web project sales to use. You can find an overview of all other services here .

Sell a web project on Projektify

Are you also considering selling your web project? You are at the right place at Projektify with this concern! As a free platform, our association offers you support in buying and selling web projects. With us you can create a sales offer for free. To do this, just click here .

But even if, on the contrary, you want to acquire a web project, we can help you. Please have a look at ours for more details Show !

We are also happy to advise you with our regular blog articles on various topics relating to online business and the management of web projects. We focus particularly on the topics Part-time self-employment , insolkvency and Corporate succession . So feel free to read through our other articles.

Did you like this post? Then support Projektify eV and its members with a voluntary donation or simply by clicking on one of the banners of our advertising partners. Many Thanks!